Dar confirms rolled over OF $2bn China loan, issue ‘no longer pending’

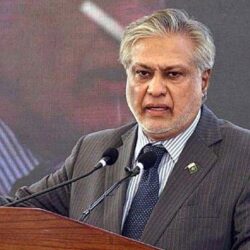

March,31(EA Report) -- Finance Minister Ishaq Dar confirmed of a $2 billion loan from China by saying that has been rolled over and is "no longer pending", denying reports that talks were still in progress.“I want to confirm that the $2 billion deposit from China, which was due on 23 March, is no longer pending,” said Dar, while answering a query raised by Pakistan Peoples’ Party (PPP) Senator Raza Rabbani pertaining to China's loan rollover at the Parliament.“Moreover, the documentation (of this loan) for 2023-24 is also completed" he said, adding that it is "no longer in the pipeline."Earlier, Reuters had reported that China is still working on a request by Pakistan to roll over the loan that matured last week, citing a top finan...

April 1, 2023 at 8:53 am | Economic Affairs