Accounting for approximately 3 per cent of Pakistan’s GDP, the automobile is the fastest growing sector in the Sub-Continent, which employs a workforce of over four million.

By Ghulam Murtaza

The creation of Pakistan had to experience great injustice by inheriting only 34 industries out of 921 in the subcontinent, which reflects how much manipulation was done. Cotton textiles, cigarettes, sugar, rice husking, cotton ginning, and flour milling industries were among the top to create just 26000 jobs and contributed around 7% to GDP. The automobile industry was not existing at that time.

General Motors & Sales were the pioneers in selling the Vauxhall Cars, and Bedford trucks, followed by Ali Automobile rolled out Ford Trucks, which paved the path for Exide Battery to launch its production after four years in 1953. Haroon Industries launched Dodge Cars in 1956. Ali Automobiles aggressively grabbed the gap by introducing Ford Angela Cars, Ford Pickups, and Ford Combi from 1958-60.

Hyundai and Kia, the South Korean brands, have announced a collaboration with Nishat Group and Younus Brothers.

The economy of Pakistan was taking off during the Ayub rule, which tempted Allwin Engineering to introduce precision auto parts in 1961 to lay the foundation for the aftermarket industry in Pakistan. After inspiring by the growth of four wheels, Wazir Ali Engineering jumped into the market to introduce Lamberate Scooter in 1962.

In 1963 Kandawala Industries introduced Jeep CJ 5, 6, and 7. Hye Sons introduced Mack Trucks, and at the same time, General Tyres & Rubber started its production in Karachi. Agri equipment Rana Tractors pioneered to assemble of MF Tractors in 1964, and Vespa Scooter and Rickshaw were introduced by Raja Auto Cars. Jaffer Industries introduced the specialized vehicle in 1965 and Mannoo Motors.

The 1972, socialism influenced PPP Government to wrap up everything under nationalization. Japan acquired 40% shares of Pak Suzuki Motor Co. In 1972, Pakistan Automobile Corporation (PACO) was formed; after Sindh Engineering was renamed Wazir Ali Engineering, Ali Autos was renamed Awami Autos, Republic Motors was renamed Haroon Industries, Gandhara Motors was renamed National Motors, Hye Sons was renamed Mack Trucks, Kandawala Industries renamed by Naya Daur Motors, Jaffer Industries renamed by Trailer Development Corporation, Rana Tractor renamed by Millat Tractor. The year 1974 will be remembered for two wheels when Dawood Yamaha introduced Yamaha Motor Cycle. In 1974 Beta Engineering started the production of Diesel Engines. Two years later, in 1976, Suzuki Motor Cycle was launched by Sindh Engineering. Saif Nadeem Kawasaki launched youth’s stylish Kawasaki Motor Bike in 1977. At the same time, Naya Daur Motors introduced Suzuki Jeep, which got very popular in government circles.

The SPEL started producing plastic parts introduced in 1978. In 1980 Awami motors assembled the famous Suzuki Pick-Ups and Sindh Engineering Mazda Trucks. Production of Agri auto parts also started in Pakistan in the year 1981 by the Agriauto Industries. Auto Industry accepted the huge positive change by the production of Suzuki cars in 1982. Vendor Development & Technical Cell (VDTC) was formed in 1983; Al-Ghazi Tractor introduced Fiat Tractors in the same year. In 1986 Pakistan Association of Auto Parts and Accessories Manufactures (PAAPAM) came into existence which organized the vender sector in Pakistan and impacted this sector mightily.

In 1986, another new company was formed, I-e Hinapak Motors, limited by the joint venture of PACO, AL-Futtaim, Hino Motors & TTC. In 1987 Gandhara Nissan started the production of Nissan Diesel Trucks.

The year 1993 is another landmark of the Auto Industry when Indus Motor started assembling the production of the Toyota Corolla and introduced the market to new horizons, followed by Honda Atlas manufactured Honda Civic. The auto and parts industry attained another milestone when PAAPAM organized the first Pakistan Auto Show in the Marriot Islamabad in 1995, setting the automotive industry on a path of localization. During the Musharraf rule, banks got very liberal and filled the roads of the country with multi-glazing brands. At the start of the Millennium, dual fuel options were introduced to run both on petrol and CNG to enhance the affordability for a commoner. Although the decision proved to be a later intuitive, for the time being, this sector witnessed great bustling.

Many small assemblers and importers of motorcycles surfaced to assemble replicas of the ever-popular Honda 70 from 2001-2007. To safeguard their business interests, the Association of Pakistan Motorcycles Assemblers (APMA) came into existence. During this period, Afzal Motors got a license from Daewoo Bus, South Korea, and Tata Daewoo and assembled locally. From 2007 to 2009, the auto sector experienced a bearish trend due to high-interest rates and the Yen’s appreciation against the PKR. But this recession proved to be short living, and the industry rebounded. The auto industry filled the market demand with the app. US$88 million during this decade.

Motorcycle production also set a new record in 2016–17, producing 2.5 million units. In 2015, the Auto Policy 2016-21 fascinated new producers in the market traditionally dominated by Honda, Toyota, and Suzuki. The fully documented auto industry stood as the second-largest indirect taxpayer, followed by the petroleum industry in Pakistan. During this period, Toyota started the local assembly of its sedan Corolla. United Motors made the first local car. Ghandhara Nissan began producing Isuzu d-max in Pakistan. Pakistan Rose by 171% between just 2014 and 2018.

That accounted for app. 3% of Pakistan’s GDP and employs a workforce of over 4 million people as of 2018; Pakistan is the 35th largest producer of automobiles. Its contribution to the national exchequer is nearly ?50 billion (US$220 million). Pakistan’s auto market is among the smallest but fastest-growing in this continent. Two hundred sixty-nine thousand seven hundred ninety-two cars were sold in the year 2018 but declined to 186,716 in 2019 due to Covid19. Currently, the auto industry the auto market is mostly dominated by Honda, Toyota, and Suzuki.

However, on March 19, 2016, Pakistan announced the “Auto Policy 2016-21” (2021 to 2026) which attracted Renault, Nissan, Proton Holdings, Kia, SsangYong, Volkswagen, FAW, and Hyundai. MG JW Automobile Pakistan has signed an MoU with Morris Garages (MG) Motor UK Limited, owned by SAIC Motor, to bring electric vehicles to Pakistan. NLC signed an agreement with Mercedes Benz for the manufacturing of Mercedes Actros trucks in Pakistan. A few old models of vehicles, including the Bolan and Ravi, continue to be sold by Suzuki. On July 8, 2021, Jolta Electric launched the production of electric motorcycles.

Current Scenario of Pakistan Automobile Industry

On December 26, 2021, the Government of Pakistan announced a five-year policy between 2021 and 2026 to raise the auto sector. On October 20, the Pakistani envoy to China said during a meeting with 50 Chinese automotive brands that Pakistan would increase its automobile production to 6-8 million units in the next five years. Pakistan is building special economic zones where Chinese companies are setting up their businesses. In that meeting, 10 Chinese have got ready to invest in Pakistan. Understanding is developing between the Gwadar Development Authority and the PAAPAM to develop an auto city in Gwadar economic zone which will introduce this industry to new. Pakistan has almost attained 95% localization for tractors and motorcycles, 50 % for cars, and 20-25% for trucks and buses.

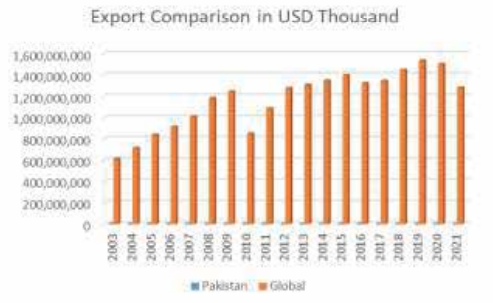

Exports of auto parts have never been encouraging if benchmarked with the other countries in the region clearly indicate the spectrum of available space. Only auto parts have a safe 5-6 billion potential for exports, regarding automobiles export. Millat Tractors Ltd (MTL) has made good export- inroads. Podiums are being removed to expand the path. We will have to see the issues hampering our exports like irrational duties, technology transfer by our OEMs, low export marks, rebates, and capacity building to meet the modern challenges. The industry is still thriving despite all oddities; this is an exemplar of the potential it has.

Future: ‘If your direction is right, you have a future, no matter at what speed you are crawling!’. The auto sector, which is currently contributing just 3% to GDP, has much more potential to single-handed shift the economic paradi. The current auto policy from 2021-26 has a lot to allure the foreign investors. Pakistan has 8-10 cars per 1000 people. This is the lowest ratio among emerging economies per s potential of growth.

An approximated fluxing of millions of youth in the mainstream economic activities will cause drastic market demands. The local market of 230 million has great depth. The current car production in Pakistan is just 175000 per annum against the 70 million population Thailand producing 1.2 million and total four wheels 2 million. As soon as the Gwadar port gets operational, we will enter into a new era with the duty and tax-free facilities in Gwadar. Gwadar port has a 120 berths capacity. Suppose only 20 berths cargo handling of 75000 MT mother vessels require, averagely @ 10000 kg per 20FCL, we 7500 truck per vessel and 150000 truck per 20 vessels. You can be surprised to calculate the number of other vehicles to support this gigantic logistic activity.

The recently concluding Pakistan Auto Show was flocked by hundreds of thousands of trade and enthralled visitors. At the shows, I experienced the OEMs were getting in line with the market needs. Electric cars and logistic careers were reflective of modernism. A little bit of R&D could give mighty wings to the auto industry in Pakistan. As per Pakistan Gulf Economist reports, “German giant Volkswagen has shown its desire to invest in Pakistan. German Audi is going to be one of the leading investors in the auto sector of Pakistan.

The plan of the French Renault to invest $100 million in the Ghandhara Nissan plant in Pakistan has sent a wave in the Pakistani auto sector. Hyundai and Kia, the South Korean brands, announced a collaboration with Nishat Group and Younus Brothers. Moreover, automakers currently working in Russia, Italy, Thailand, China, UAE, and Turkey are keen to invest in the burgeoning auto sector of Pakistan.” A Chinese delegation representing 500 auto manufacturers and assemblers visited Pakistan to explore investment opportunities in the recent past. These investors consist of assemblers of cars, heavy-duty trucks, engines, auto parts, and tires.

Khalid Mushtaq Motors, Dewan Farooque Motors Ltd., truck production of Hinopak, and bus production of Hino and Isuzu augur are getting part of the auto industry in Pakistan. The Auto Policy 2016-21 attracted significant investments in the auto sector of Pakistan.

The writer is General Secretary of The Pakistan Association of Automotive Parts & Accessories Manufacturers