By Imran Zia

We are proud and gratified to Allah Almighty on this special occasion of 75th Independence Anniversary of Pakistan. At the time of its creation, Pakistan did not have enough capital to form a functioning government to serve its 24 million population and 8 million migrant refugees, nor it had the central bank to maintain foreign exchange reserves and issue currency. In 1947 Pakistan had only Rs.200 million worth of foreign exchange in central treasury and income of Rs.450 million against the expenditure of more than Rs.800 million.

The leadership of newly-established country under the stewardship of Quaid-e-Azam worked selflessly to lay strong foundations of the country where its people can prosper as per their ideals.

Presently, Pakistan’s biggest industrial sector is textile and clothing, which contributes 8.5% to GDP, 61% of total exports and providing direct employment for about 40% (19 million) of industrial workforce.

However, the first five-year plan aimed economic prosperity was launched in 1951. As a result of planned economic development within fifteen years of independence, Pakistan was considered among the fast growing developing countries with average GDP growth rate of over 6 percent. In early 1960s, the Far East Asian countries copied Pakistan’s five-year development plans to replicate it in their countries as a successful model for economic development.

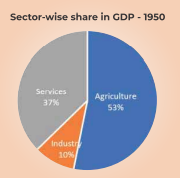

Pakistan inherited mainly an agrarian economy at the time of independence and in 1949-50 the shares in GDP of agriculture was 59.9%, industry 9.6% and services 37.2 %. With a very narrow industrial base, Pakistan got only 34 industrial units out of 921 industrial units in Sub-Continent, mostly consisting of small-scale industrial units. These industries were two cotton textile mills, one cement factory, one cigarette factory, two sugar mills, rice husking, cotton ginning and flour mills; that employed a little over 26,000 employees. There was no steel, engineering, petrochemical, electrical /mechanical and defense ordnance industry in Pakistan in 1947-48.

Pakistan’s early industrial development in the fifties was based upon import substitution industrialization under high tariff barriers and an overvalued exchange rate. In the fifties those industries were preferred that use mainly locally available raw materials like textile, sugar, food processing /consumer goods, cement, etc. During the period 1947 to 1955 the country achieved high growth rates of manufacturing of 17 percent, which was higher than other South Asian countries.

The iron & steel industry comprises around 500 smaller/ medium and large mills mainly owned by private corporates, having production capacity of around 9 million tons in 2021.

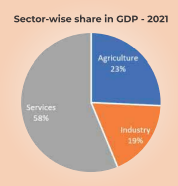

After 25 years of independence the share in GDP of industry increased from 9.6% to 22% and share of agriculture decreased from 53% to 36%, while share of services sector increased from 37% to 42%. After 75 years the share in GDP of agriculture sector decreased to around 23 percent, industry’s share is 19 percent, and services sector share increased to 58 percent.

Pakistan’s economy grew at an impressive GDP growth rate of 6 percent per year through the first four decades of the nation’s existence and in 1990s the GDP growth rate was 4.6%, however, in later years it was cycles of boom and bust. The GDP growth remained in the range of 3% to 6%, except for few years when it touched 7% or above.

Pakistan’s journey of industrial development has come a long way and now it is a developing country with sizable industrial base. Major industries of Pakistan include textile & clothing, food processing /consumer goods, sugar, automobiles, iron & steel, cement, fertilizer, petroleum, tobacco, chemicals, engineering, electrical /electronics, automotive tyres, machinery, home appliances and defense related industries.

Textile Industry

Presently, Pakistan’s biggest industrial sector is textile and clothing, which contributes 8.5% to GDP, 61% of total exports and providing direct employment for about 40% (19 million) of industrial workforce. Textile industry also provides support to over 9 million cotton producing farming families (cotton is one of major cash crops), as Pakistan is the fifth among the cotton producing countries in the world. Pakistan textile industry has the largest production chain from raw cotton to ginning, spinning, weaving, dyeing, finishing, and fabric, home textiles, garments, fashion branding to retail stores. Pakistan has the third largest spinning capacity in Asia after China and India and contributes 5% to the global spinning capacity.

In 1947 there were two textile mills (Okara Textile Mills and Lyallpur Cotton Mills) with 80,000 spindles and 3,000 looms only which could produce 8% of the domestic demand at that time. During early years after independence the development of Textile Industry by making full use of abundant locally available cotton has been a priority area towards industrialization.

Over past 75 years, the success story is that number of textile mills increased from two in 1947 to 561 by 2021 (44 weaving units, 40 composite units and 477 spinning units) and spindles from about 80,000 to 11.3 million, 3 million rotors, 28,500 shuttle-less looms, 375,000 power looms, 18,000 knitting machines and processing capacity of 5.2 billion square meters.

In 1950 textile industry started its footprints in Pakistan, when a top garment company Crescent Textile Mills Limited was founded. The following major textile mills have been established since 1951, and the journey continues:

i) Nishat Mills Limited was established in 1951 and its chairman is Mian M. Mansha. It has its retail stores all over Pakistan and also in UAE and UK.

ii) Fateh Textile Mills was established in 1952 at Hyderabad and owned by Mr. Inayat Ullah is also the Chairman Fateh Group.

iii) Gul Ahmed Textile Mills Limited was established at Karachi in 1953 by its founder Haji Bashir Ali Mohammad. It has chain of retail stores “Ideas” across Pakistan.

iv) Kohinoor Textile Mills, Rawalpindi was founded in 1953, leading yarn and cloth manufacturer owned by Mr. Tariq Saigol.

v) Chenab Fabrics & Processing Mills Limited, Faisalabad and later converted to Chenab Limited, was set-up in 1974 and its chain of retail outlets are known as “Chen one”. It is owned by Mr. Mian Mohammad Latif

vi) Younus Textile Mills Limited, Karachi is the biggest exporters of home textiles to Europe, USA and Canada. Its dynamic CEO is M. Ali Tabba.

The above industries are not only catering the local requirements of fabrics and garments but are also major exporters of various textile products. Ready-made garments industry has emerged as one of the important small /medium-scale industries in Pakistan.

These readymade garments have large demand both at home and abroad. The major men’s fabric and ready-made garments brands are Bonanza, Junaid Jamshid, Cambridge, Uniworth, Chen One, Outfitters, Breakout, Royal Tag, Charcoal, etc. In women fabrics and clothing Khaadi, Nishat Linen, Gul Ahmed, Bareeze, Al Karam, Beechtree, Warda, Sapphire, Ethnic, etc. are the famous brands.

Fertilizer has been one of the key contributors to productivity growth in agriculture sector since the Green Revolution that began in the 1960s in Pakistan.

The annual volume of total world textile and clothing trade was US$ 1.0 trillion in 2021, which is growing at 2.5 percent. Out of it, Pakistan’s share is less than one per cent. Pakistan exports of textile and clothing were US$ 19.33 billion out of total exports of US$ 31.8 billion during FY 2021-22. There is clear potential of increasing exports of textiles and clothing by reducing the anti-export bias in tariffs. International brands working in Pakistan with local textile mills are namely; H&M, Levis, Nike, Adidas, Puma, Target etc.

Although the textile and apparel industry in Pakistan is catering most of the demand for fabrics and garments and is exporting textiles & clothing worth US$ 19.33 billion, which is more than 60 percent of total exports in 2021-22, still it is only 1.9 percent of world trade in textile and clothing.

Pakistan has lowest production of blended yarn as compared to other regional exporters of textile products. Further, there is need to enhance the value-added exports of textile/clothing and men/ women garments.

Iron & Steel Industry

Steel industry is considered as the backbone of engineering, automobile industries and construction sector, as it provides raw material to these industries. Steel products are broadly classified into long & flat products and tubes & pipes. Pakistan’s total steel products’ (both long products and flat products) consumption during FY 2020-21 was 11.0 million tons, out of which 73% of the country’s demand is met through local production i.e. 8 million tons and remining 27% i.e. 3 million tons by imports. Pakistan’s per capita steel consumption stands at 36Kgs in 2020, significantly lower than the world’s average of 229Kgs, indicating an immense potential of growth in steel sector.

Pakistan’s first largescale iron & steel unit i.e Pakistan Steel Mills (PSM) was established in the public sector with investment of US$ 24.7 billion, which started commercial operations in 1984 and has a production capacity of 1.10 million tons per annum of steel products i.e. Billets, Hot Rolled, Cold Rolled, Galvanized, Form Section, Pig iron, Coke, Oxygen & Nitrogen, Refractory Bricks. However, PSM has been offline since 2015.

The iron & steel industry comprises around 500 smaller /medium and large mills mainly owned by private corporates, having production capacity of around 9 million tons in 2021. Currently the organized steel sector is privately owned companies that comprises of top 20 major producers, whose share in domestic market is around 60 -70%. Steel sector contributes 9.5% to the GDP and has a notable weightage of 5.4 % in the composition of LSM.

Pakistan’s total consumption of Flat Iron & Steel Products i.e. Cold Rolled Coil (CRC) and Galvanized Steel Coil (GSC) in the year 2021 was around 1.60 million tons. Flat Iron & Steel products manufacturing industry consists of two units namely International Steels Limited (ISL) and Aisha Steel Mills Limited (ASML) with a total installed capacity of 2.0 million tons. ISL and ASML are cater to most of the flat steel demand around 73%, while the remaining 27% was met through imports and both units have exported GSC in 2021. The flat steel products industry uses imported Hot Rolled Coils (HRC) from around eight countries that is around 85% of total cost of CRC and GSC. Zink is also imported, and other raw materials mainly chemicals are locally available.

Long Iron & Steel Products are Cast /Rolled Billets, Hot Rolled Deformed Bars, Mild Steel Plain Bars, Cold Twisted Steel Bars, Ribbed Bar. There are around 20 major producers of long steel products including Amreli, Agha, Mughal, Frontier Foundry Steel, Faizan Steel, Razaque, Aitamad, and Ittehad steel are well known with around 70% market share. The major raw material of long steel products industry is iron & steel billets, produced in arch furnaces from imported iron & steel scrap. The value addition of long steel products industry is higher than the flat steel products industry, mainly due to backward integration by way of producing iron & steel billets locally.

Fertilizer Industry

There was no fertilizer plant in Pakistan at the time of its independence and use of fertilizer began in 1950s through imports. In Pakistan the nitrogenous chemical fertilizers (urea) were introduced in 1952, phosphorus in 1959 and potassium in 1967. The success story of 75 years is that now there are six major fertilizer manufacturers having installed capacity to produce 9 million metric tons per annum of all types of fertilizers. The production capacity 9 million tons per year is more than the total domestic requirement of fertilizer over the last few years. The production remained around 8 – 8.4 million metric tons, out of which the production of urea fertilizer was 5.92 million metric tons. Around 80 percent of the all types of fertilizers consumed in Pakistan are produced locally, with domestic production supplying 83 percent of the nitrogen (urea), 51 percent of the phosphorus, and 47 percent of the potassium-based fertilizer.

Initially, fertilizer plants were established through joint ventures with foreign companies, such as Pak-American Fertilizers (now Agritech, which was established in 1958) and Pak-Arab Fertilizers (established in 1973). Engro Fertilizer Limited (established in 1968) has current installed capacity of 3.5 million metric tons per annum. Fauji Fertilizer Company (FFC), (established in 1978) has installed capacity of 2.5 million metric tons per annum, Fauji Fertilizer Bin Qasim Limited is a subsidiary of Fauji Fertilizer Company Limited, (established in 1993) and both are controlled by the Fauji Foundation. The other fertilizer plants are Dawood Hercules incorporated in 1968 having production capacity of 445 thousand tons of urea, Fatima Fertilizers started production of urea in 2010 having production capacity of 500 thousand tons and is the market leader in Calcium Ammonium Nitrate (CAN), Nitrogen Phosphorus (NP), and Nitrogen Phosphorus Potassium (NPK) production. The main feed stock of the fertilizer industry is natural gas. According to CFO of Engro Fertilizers the local fertilizer industry has enabled the country to substitute imports of US$5.5 billion in 2022, through local production of fertilizers.

Fertilizer has been one of the key contributors to productivity growth in agriculture sector since the Green Revolution that began in the 1960s in Pakistan. The use of all types of fertilizers has increased the production of wheat, rice, maize, sugar cane, cotton, and other agriculture crops manifolds, enabling Pakistan to meet its increasing requirement of wheat, rice and maize for its population growing at the rate of 2.4 % per annum.

Cement Industry

Pakistan at the time of independence only had one cement plant at Wah, in Punjab. Cement industry is another important industry that uses abundantly available local raw material and it grew from one cement plant in 1947 to 25 cement plants in 2022. During past 75 years the capacity of cement industry increased from 350,000MT to 40.5 million tons in 2021. Pakistan’s cement industry is currently running at 92 percent capacity. Pakistan is the world’s 14th largest producer of cement. In terms of installed capacity top 6 cement manufacturers are Lucky Cement, Bestway Cement, D.G. Khan Cement, Cherat Cement, Fauji Cement and Maple Leaf Cement comprised 82% of total installed capacity. Average capacity utilization over the last decade has ranged from 73% to 90%

Cement is the one of the major raw materials used in the construction industry. Cement consumption has a direct correlation to economic growth and improvement in the living standards of society. The per capita cement consumption in Pakistan is around 182 kg, whereas, the world average per capita consumption is around 500 kg, showing an opportunity of higher demand with the rapid growth in GDP and per capita income. With the growth in population from 38 million in 1947 to 224 million in 2021 and migration from rural areas to urban cities, there has always been a shortage of millions of housing units. Pakistan is experiencing Asia’s fastest-growing urbanization and studies show that half of the population of Pakistan will be living in cities by 2030. Similarly, construction of dams, bridges, office buildings, commercial markets/plazas, big infrastructure, and housing projects kept robust growth in the demand for cement.

The industry operates in two separate regions /zones – North and South – with Northern region comprising Punjab and KPK representing around 80 percent of the total production capacity and sales. The manufacturers in the South region mainly cater the demand of Sindh and Balochistan and export cement to several countries by sea. The export potential for manufacturers in the Northern region, however, is limited to mainly Afghanistan.

Electronics Goods & Home Appliances Industry

The electronics and home appliance industry of Pakistan started in 1980’s due to fiscal incentives offered by the Government to substitute imports. Pak Electron Ltd (PEL) and Dawlance started manufacturing refrigerators in 1980 and now there are more than 18 famous brands manufacturing many electronics and household appliances Refrigerators, Air-Conditioners, Freezers, Washing Machines, Microwave Ovens, and Water Dispensers in Pakistan, besides 2-4 assembling units of foreign brands like Gree, Samsung and LG.

The manufactures of famous home appliances in Pakistan, started production in early 1980s were Pak Electron Ltd, and Dawlance Pakistan, Waves Pakistan Limited (formerly known as Cool Industries (Pvt.) Limited), and other brands were mainly established 2001 onwards like Orient Electronics, Haier Pakistan, TCL Electronics Pakistan (Pvt) Ltd., Digital World Pakistan (DWP) Group – Gree & EcoStar, Changhong Ruba, and R&I Electrical Appliances (Pvt) Ltd. – Kenwood.

The estimated size of the household appliance market was around Rs.215 billion and it contributes 4% to the LSM. in 2021. Domestic production of refrigerators in 2021 was 2.2 million units, LED TV 1.2 million units, air conditioners 1.5 million units, washing machines 2.5 million units, deep freezers 500,000 units and water dispensers 500,000 units. This industry uses around 40% local raw materials, parts /components, however, the major components like compressors, evaporator and condenser in refrigerators & freezers, split air conditioners and LED panels are imported into the country and assembled locally.

Despite low use local content, the industry has substituted more than US$.1.3 billion worth of imports annually.

Chemical Industry

Pakistan made a considerable progress in the production of basic inorganic chemicals such as Chlorine, Soda Ash, Caustic Soda, Sulphuric Acid, Formic Acid, etc. In Pakistan, sufficient production capacity of these chemicals is available, not only to cater the needs of the local textile, glass, soaps & detergents, edible oil, paper & paperboard, leather and synthetic leather industry, but surplus production is being exported around the world. In polymers Pakistan is only producing PVC Resin.

Presently, there are four plants producing Caustic Soda having production capacity of around 527,000 MT per year, namely Sitara Chemical Industry Ltd, Ittehad Chemicals Ltd, Engro Polymers and Chemicals Ltd. and Nimir Industrial Chemicals, (for in house consumption in production of soap noodles). Caustic Soda is a highly versatile chemical used in soaps & detergents, in petroleum refining, paper, textiles for making mercerized cotton, in edible oil industry for purification of fats and oils and removal of fatty impurities.

Soda Ash industry comprises of two units i.e. ICI Pakistan Ltd., and Olympia Chemicals Ltd., having production capacity of 650,000 MT per year. Soda ash is an essential ingredient in the manufacturing of detergents, glass, paper, sodium silicate, cleaning compounds and industrial chemicals.

Two local units are producing Hydrogen Peroxide in Pakistan namely Siatra Peroxide and Descon Oxychem having installed capacity of 70,000 MT per year. It is used as bleaching agent in textile industry, paper & pulp industry, for sterilization of packaging material of milk, fruit juices, etc. The local industry is fulfilling around 70 -80% of total demand for Hydrogen Peroxide.

Engro Polymer and Chemicals Limited is sole manufacturer of PVC in Pakistan. PVC is used in manufacturing of Pipes & Fittings, Garden Hose, Shoes, Cable, Films & Sheets, Compounding, Packaging, etc. The production capacity of Engro Polymers is 300,000 MT per annum, and it has also set up production facility of VCM, Chlorine, Caustic Soda. Engro Polymers is catering 80 -85% market of PVC Resin.

The Chemical industry has substituted imports of chemicals to some extent, however, the imports of chemicals were US$ 14.08 billion in FY 2022 and their share in total imports was 17.56%, the second highest level of imports after petroleum products.

Sugar Industry

Starting from 2 sugar mills in 1947 today, Pakistan has around 68 sugar mills that are in production – 34 in Punjab, 28 in Sindh and 6 in KP. The industry employs more than 100,000 labour force while more than 9 million people of rural population are involved in the production of sugarcane. Its share in the large-scale industry is 18% and 1.9% in GDP. The sugar production during FY 2021-22 is 7.2 million metric tons (MMT), whereas, sugar consumption for 2021-22 is forecasted at 6.1 MMT. The sugar industry in Pakistan is not only capable to meet the entire demand for sugar needs of the country, but also exports the excess sugar stocks.

The writer is an economist and Director General, National Tariff Commission, Islamabad.