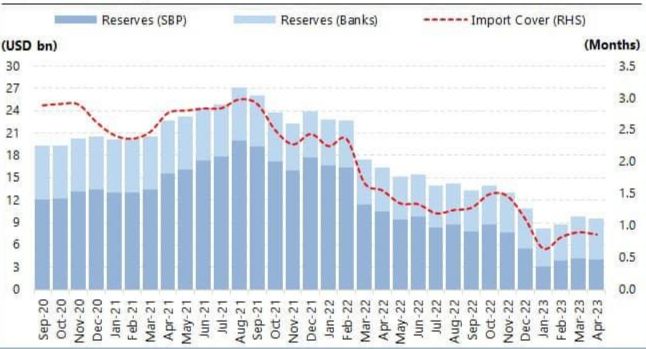

April,13(A. E Report) ——State Bank of Pakistan (SBP) Foreign exchange reserves decreased $170 million, clocking in at $4.04 billion as of April 7, data released on Thursday showed.

The overall number stands at a critical level at around a month of import cover.

Total liquid foreign reserves held by the country stood at $9.56 billion. Net foreign reserves held by commercial banks clocked in at $5.53 billion.

“During the week ended on April 7, 2023, SBP’s reserves decreased by $170 million to $4,038.3 million due to external debt repayments,” said a statement from SBP.

Last week, foreign exchange reserves of SBP decreased $36 million.

On Wednesday, an official of the International Monetary Fund (IMF) expressed confidence that the staff-level agreement (SLA) will be signed soon followed by the IMF Board’s approval.

According to the Finance Division, IMF Director of the Middle East and Central Asia Jihad Azour hoped Pakistan would continue its progress on the reforms in various sectors.

Last month, Pakistan received the second disbursement of $500 million from the Industrial and Commercial Bank of China (ICBC).

Cumulatively, Pakistan has received $1.7 billion from Chinese institutions with another $300 million expected.

Moreover, China has also rolled over a $2-billion loan.

Delay in an agreement with IMF is taking a toll on the economy, particularly the rupee.

Earlier during the week, rumours floated that UAE would pledge funding to Pakistan which would pave way for unlocking the next tranche of IMF.

A shortage of foreign currency reserves has added pressure on the economy that relies heavily on imports to run its engines. While the SBP has put some curbs on inward shipments, reducing the current account deficit in the process, many businesses have been forced to either shut down or scale back operations as policymakers scramble to arrange dollar inflow.