EA Report

LAHORE, Oct. 8– Pakistan equities on last day of the week made an intraday high of 44,670 but slid down to 44,477 level by market close.

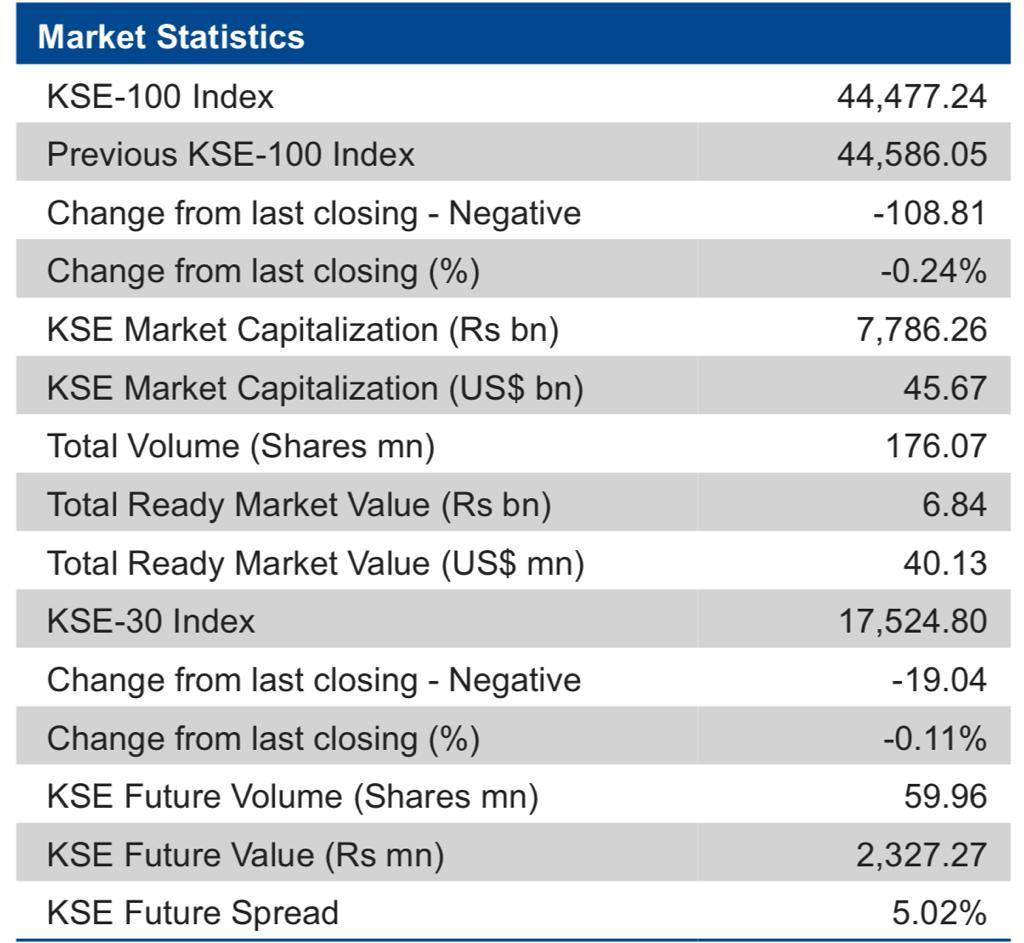

Pakistan’s stocks traded in a narrow range on the last day of the week with the benchmark KSE-100 Index settling 0.24% lower on Friday amid substantially low volumes.

The index touched an intra-day high 44,670.5, but failed to sustain the gains, eventually settling just below 44,500.

Major contributors to the total volume of 176mn shares were WTL (-0.4%), TELE (-3.1%), SILK (2.6%), FCSC (31%) & TPL (-3.8%).

Sectors dragging the benchmark KSE-100 Index lower on Friday included cement (77.06 points), pharmaceutical (28.16 points), and power generation and distribution (25.49 points).

On the news front, World Bank has revised down Pakistan’s GDP growth projection to 3.40% for FY22. The market needs strong triggers to overcome the 45,000 level.

State Bank of Pakistan (SBP) latest data, remittances reached $2.7 billion during September 2021, increasing 16.9% on a yearly basis.

Moreover, cumulative inflow under the Roshan Digital Account (RDA) reached $2.411 billion in September. As per the central bank data, 248,723 accounts have been opened from 175 countries during the 13-month period.

Experts advised Investors therefore to stay cautious and build exposures only on major dips in the market especially in the Banking, Fertilizer, Steel and Cement sectors.