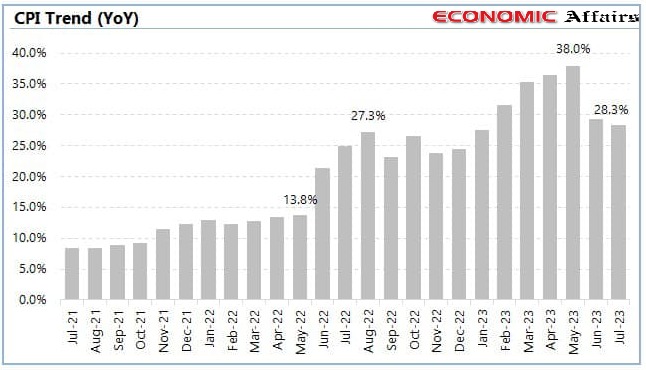

Aug. 01 (E.A Report) — Pakistan’s July headline registered a marginal decline, clocking in at 28.3% on year-on-year basis in July 2023, comparing previous month increase of 29.4% and 24.9% in July 2022.

On a month-on-month basis, it increased by 3.5% in July, showed data released by the Pakistan Bureau of Statistics (PBS) on Tuesday.

The headline inflation figure is higher than expectations. It was earlier projected that the CPI figure would stand in the range of 25-27%.

According to PBS data, food group, which commands a significant weight of 34.58%, increased to 272.44 in July 2023 as compared to 261.78 in June 2023, a gain of 4.07%.

In its Monthly Economic Outlook for July, the Ministry of Finance stated that inflation is expected “to ease out” in July compared to the previous month, and “remain in the range of 25-27%”.

Rural and urban inflation

CPI inflation in urban areas clocked in at 26.3% on a year-on-year basis in July 2023 as compared to an increase of 27.3% in the previous month and 23.6% in July 2022.

On a month-on-month basis, it increased to 3.6% in July 2023 as compared to an increase of of 0.1% in the previous month and an increase of 4.5% in July 2022.

Meanwhile, CPI inflation in rural areas increased to 31.3% on year-on-year basis in July 2023 as compared to an increase of 32.4% in the previous month and 26.9% in July 2022.

On a month-on-month basis, it increased to 3.3% in July 2023 as compared to a decrease of 0.8% in the previous month and an increase off 4.2% in July 2022.

Economic situation

High inflation is just one of the issues currently putting Pakistan’s economy in distress.

However, in a major development, the International Monetary Fund (IMF) Executive Board, on July 12, approved the new nine-month, $3-billion stand-by arrangement, addressing some concerns on the balance-of-payments’ position.

Following the approval, Pakistan’s central bank received $1.2 billion from the IMF as the first tranche of a $3 billion SBA.

Moreover, the country also received inflows to the tune of $3 billion from bilateral partners including Saudi Arabia and UAE.

Rise in dollar inflows helped halt the decline of foreign exchange reserves.

As per latest data, total liquid foreign reserves held by the country stood at $13.53 billion. Net foreign reserves held by commercial banks stood at $5.34 billion.

SBP Monetary Policy Committee (MPC) also kept the key policy rate unchanged at 22% in its latest announcement made on Monday.

Central bank in its statement noted that the economic uncertainty has decreased since the last meeting, whereas near-term external sector challenges have been largely addressed and investor confidence has shown improvement.

“The MPC particularly noted that year-on-year (y/y) inflation is likely to remain on downward path over the next 12 months, which implies a significant level of positive real interest rate,” the SBP said in a statement.