Allah has gifted Pakistan with a lot of diversity in terms of demographics, ethnicity, geography, economic and natural resources. Not many countries can boast such a diversity especially within the range of comparable size.

By Muhammad Mazhar Khan

Pakistan turned seventy-five on 14 August 2022 and the country has witnessed a lot of transformation during these years. With the initial struggles for survival to near take-off in 1960s to the structural challenges of recent decade, each decade has its own story. Overall, the economic history of Pakistan is a tale of unfulfilled promises with spurts of boom and bust cycles. Growth triggered by consumption boom fails to sustain as economy overheats quickly. There can be many explanations but none of them is more convincing than mismanagement by successive governments and a general behavior of rent seeking by the private sector and households.

Allah has gifted Pakistan with a lot of diversity in terms of demographics, ethnicity, geography, economic and natural resources. Not many countries can boast such a diversity especially within the range of comparable size. For instance, Pakistan has vast areas of fertile agricultural lands, skillful human resource, two of the highest mountainous ranges in the world with substantial tourism potential, unexplored natural resources especially of metals and minerals, two fastest growing and most populous neighboring countries and resource rich landlocked neighboring central Asian states. Each one of these in itself has potential to lead the country to greater and faster economic growth. Alongside this diversity, the country has been marred with regional conflicts and internal political instability. The article is an attempt to briefly look back and assess Pakistan’s economic performance, compare it with some peer countries, identify gaps and suggest a broad policy direction.

A desirable transition would be from agriculture to industry and eventually services sector takeover.

At the time of independence, Pakistan faced an extreme resource crunch. The industry and financial sector were almost nonexistent, even for currency issuance reliance was on India. The human resource was largely uneducated and unskilled. The financial and economic resources needed to run the newly independent country were scarce and neighboring environment was challenging and intimidating. It was nearly a miracle to survive those early years. Only dependable resource was the agriculture sector.

Every decade has its own story

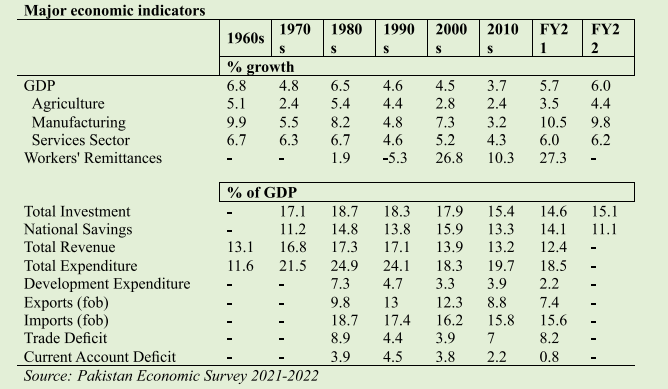

Initially, Korean war and the policy to avoid depreciation helped accumulate investable surplus for the economy and some industrial footprint started to get hold in 1950s. The 1960s witnessed rapid growth in all sectors of the economy. The growth was led by manufacturing sector. The agriculture sector benefitted from the initiatives undertaken during the green revolution and the development of canal water system.

The 1970s was a challenging decade. It started with the split of the country. The government socialist policies were in a complete contrast to the policy focus of 1960s. An adverse international oil price shock and major floods didn’t help either. Government started long-term projects in industrial and agricultural sectors and long gestation periods meant lower current growth. However, in the external sector, the policy of devaluation and sending labor abroad generated export and remittance proceeds.

The 1980s benefited from higher foreign assistance and increased remittance flow from booming Middle Eastern countries, and from the completion of long-term projects. The government also shifted its focus back to private sector, and small-scale manufacturing remained played a major role in economic growth. As a frontline state in Afghan war, Pakistan received greater military and financial aid.

The 1990s was a lost decade as the economic growth came down substantially. The fiscal and current account deficits increased and social indicators worsened. Though agriculture growth remained supportive, manufacturing growth decelerated to almost half of the 1980s. The structural adjustment and liberalization of trade and financial sector exposed the private sectors to greater competition.

The 2000s witnessed substantial growth in first seven years mainly helped by debt restructuring and foreign exchange inflows. The manufacturing sector showed robust growth and led the economic revival. However, global financial crises dried foreign inflows and the oil price shock swelled the trade deficit to unsustainable levels. Ensuing structural adjustment process meant growth decelerated substantially. The sharp rise in oil prices also created energy crises, as oil was the major fuel. A promising decade ended in growth momentum losing steam.

Looking through the numbers’ lens

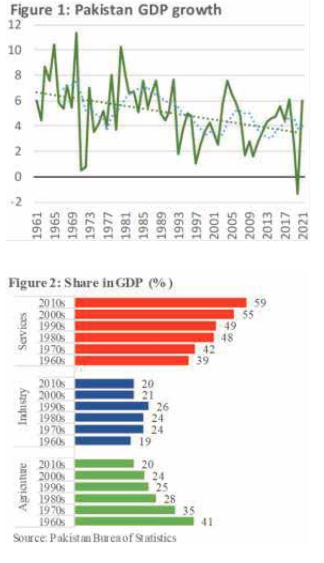

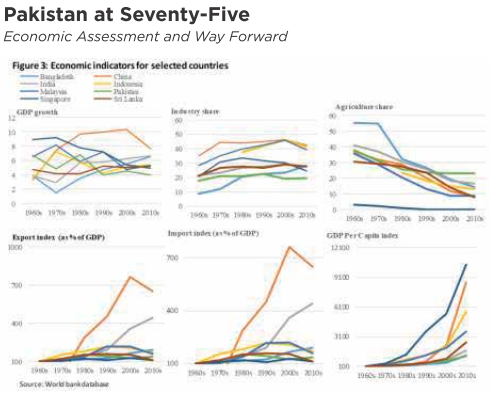

Pakistan attained GDP growth rates in excess of 6 percent 1960s and 1980s and since 1990s, the average GDP growth rates have gradually tapered off. With natural bounds on agriculture growth the services sector led the weak growth momentum. The major drag on GDP came from the suboptimal growth in industrial sector. The change in sectoral shares over the decades reveal that industrial sector lagged behind with the agriculture’s share gradually translating services sector and missing the industrialization stage almost altogether. A desirable transition would be agriculture to industry and eventually services sector takeover.

The investment ratio remained low over the decades. The lack of domestic savings remained a major drag. In fact, Pakistan saving are is one of the lowest in the world. The low investment ratio reflects low fund mobilization for industrialization and high consumption ratio and a very low tendency to save.

The fiscal position is also not encouraging. Except for 1960s and 2000s to some extent, the fiscal deficit is higher than the generally considered safe limit of 4.0 percent of GDP. The expenditure on development remained constraint and have actually declined substantially since the 1990s.

The main fiscal constraint is the lack on tax revenue. The tax revenue has declined as percent of GDP since the 1980s. The revenue constraint is so binding that the total expenditure have fallen by around 5 percent of GDP since 1980s. Low savings rate and inability to broaden the tax base has adversely affected investment. Thus, investment, industrialization and eventually high GDP growth remains elusive.

A similar story manifests in the external sector, after peaking in the 2000s at around 12 percent of GDP the exports fallen to around 9 percent. Whereas, the imports remained around 16 percent over the decades, signifying a large trade deficit to finance. The over consumption through imports constraints the investments from foreign savings. The situation could have been much worse if it was not for a substantial inflow of foreign exchange from remittances.

The recurrent and high level of fiscal and trade deficits resulted in accumulation of domestic and external debt. This debt accumulation in turn further burdens the fiscal accounts and need to borrow externally.

The writer is Senior Economist in the Economic Policy Review Department of the State Bank of Pakistan.