Muhammad Aurangzeb

President & CEO – HBL

Profile:

Prior to this responsibility at HBL, Mr. Aurangzeb was the CEO for JP Morgan’s Global Corporate Bank based in Asia, with a rich international banking experience of over 30 years in other senior management roles at ABN AMRO and RBS based in Amsterdam and Singapore. Mr. Aurangzeb is the only Pakistani to be invited to the exclusive membership of the Global CEO Council organized by WSJ / DowJones group. He is also the Chairman of the Pakistan Banks Association, Chairman of the Pakistan Business Council, and Council Member at the Institute of Bankers Pakistan.

Mr. Aurangzeb received his BS and MBA degrees from The Wharton School (University ofennsylvania).

An Overview of HBL

HBL is the first Pakistani commercial bank to be established in Pakistan, in 1947. Over the years, HBL has grown its branch network and maintained its position as the largest bank in the private sector with 1650+ branches, 2100+ ATMs, 45,000+ Konnect by HBL agents (branchless banking platform), 55,000+ QR locations serving over 30 million clients worldwide. It is currently the largest domestic bank with a presence across major trade zones in the world. The Bank is recognized as the leading financial institution of the country for its client centric innovation in financial services.

Following is the transcript of the interview;

The Economic Affairs: What is the significance of HBL as compared to other organizations with reference to Diamond Jubilee independence anniversary of Pakistan? Tell us the success story of HBL spanning over 75 years and please highlight major achievements of the Bank.

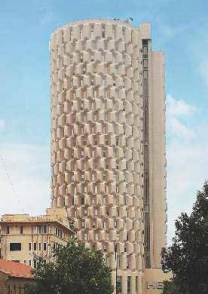

Muhammad Aurangzeb: HBL was established in 1941. The Bank moved its operations to Pakistan in 1947 at the request of the Quaid-e-Azam, Muhammad Ali Jinnah, hence becoming the first commercial bank in the country.Embarking on a progressive journey, HBL continued to grow and expand in the successive years. The Bank’s first international branch opened in Colombo, Sri Lanka in 1951, while the iconic HBL Plaza building commenced its operations on 4 September 1971.

In February 2004, management control was handed over to the Aga Khan Fund for Economic Development (AKFED). By April 2015, the Government of Pakistan divested its entire shareholding of 41.5% through the Privatization Commission of Pakistan, making HBL Pakistan’s largest Bank in the private sector.

HBL has not just been a pioneer in the banking industry but has also been a platform that has enabled dreams for millions of people. It has time and again, proven to be a catalyst for change through initiatives that have elevated Pakistan’s image and reputation. From bringing back international cricket to Pakistan through HBLPSL, to helping strengthen the economy of the country through historic initiatives such as the Benazir Income Support Programme, HBL continues to enrich lives.

HBL won the 2022 Euromoney Award for “Best Bank in Pakistan” and the 2021 Asiamoney Award for “Best Domestic Bank”. HBL was also awarded “Pakistan’s Best Bank” Award at the Pakistan Banking Awards 2021.

Over the years, HBL has grown its branch network and maintained its position as the largest private sector bank in Pakistan with over 1,650+ branches and 2,100+ ATMs globally, serving 30 million clients worldwide.

HBL is shaping the future through a paradigm shift as a ‘Technology company with a Banking License’. The Bank’s multiple digital channels are helping it get closer to its clients through innovative and frictionless ways

As the leading financial institution of Pakistan, HBL is at the forefront of all development initiatives which includes growth of priority sectors and targeting the unbanked population in the country. HBL remains committed to its objective of financial inclusion for all segments of society.

As an independent validation of our efforts from internationally recognized publications, HBL won the 2022 Euromoney Award for “Best Bank in Pakistan” and the 2021 Asiamoney Award for “Best Domestic Bank”. HBL was also awarded “Pakistan’s Best Bank” Award at the Pakistan Banking Awards 2021.

The Economic Affairs: What role is HBL playing in Pakistan’s economy by way of providing employment, particularly maintaining gender balance?

Muhammad Aurangzeb: Diversity and Inclusion is an important agenda at HBL and the Board and the Executive Committee members lead the agenda.

The Bank’s diversity ratio continues to improve with 21% of our employees being women. HBL won eight awards in the 2021 Global Diversity and Inclusion Benchmark awards in the categories of Best Practice in Pakistan and Most Progressive in Pakistan.

A campaign for hiring people with disabilities full time and as interns was initiated in 2019 known as the ‘Together we are strong’, where HBL is collaborating with expert organisations for awareness on disability.

The Economic Affairs: In providing employment and human resource development, would you like to share the growth of HBL in terms of branches, deposits, loans, and banking infrastructure?

Muhammad Aurangzeb:

HBL’s 2021 results, underpinned by client centricity, were driven by strong organic growth. Exceptional performance across all business segments and activity drivers further cemented the Bank’s leading position across all client segments. HBL remains at the forefront of supporting government initiatives for economic development, and the Bank continued to increase private and public sector credit. HBL continues to provide innovative products and financial solutions to its clients whose banking needs are moving beyond traditional channels. The trust and confidence that our clients repose in us is a validation of our business strategy.

HBL delivered a record profit before tax of Rs 62.0 billion in 2021, 17% higher than the Rs 53.0 billion reported in 2020, signifying strong performance across its diverse business lines.

2021 was an exceptional year for HBL as it achieved several milestones across its businesses. The Bank’s balance sheet grew by 12% to Rs 4.3 trillion. This was achieved as a result of strong deposit mobilization with total deposits increasing by 19% to Rs 3.4 trillion.

HBL’s stated objective is to support its clients and the real economy through wide-ranging, but prudent, credit expansion. HBL’s total advances increased by 23% to over Rs 1.5 trillion.

The Economic Affairs: What steps has HBL taken for financial inclusion of the poor, rural and female population of Pakistan, as per the goals set by SBP?

Muhammad Aurangzeb: HBL proudly serves over 3.5 million women clients, including 750,000 under its women’s market program, Nisa, which has been recognized internationally. During 2021, the program added over 110,000 new accounts.

Konnect by HBL remains the primary vehicle for offering easy access to the unbanked and under-banked segments of society, with women continuing to make up 24% of the client base. Konnect now has 7.1 million accounts with more than 1 million monthly active users.

The Economic Affairs: HBL is considered as a leading bank introducing IT, automation/digitalization in the banking sector, and facilitating banking services in Pakistan, please share the details in this regard.

Muhammad Aurangzeb: HBL’s commitment to serving its clients with a superior banking experience is underpinned by digitization and innovation. It aims to use data driven insights to provide more contextualized products to the right audience and extend relevant banking services to previously unbanked communities while remaining true to consumer needs.

In line with its “Mobile First” strategy, HBL continued to enhance its Mobile App by partnering with a number of FinTechs and e-commerce players, developing APIs to simplify integration. More than 700,000 new users signed up for the App, taking the user base to 2.5 million, by far the largest for any commercial bank in Pakistan.

HBL Digital introduced Conversational Banking through two new channels: WhatsApp and Facebook Chat Messenger. HBL’s clients can now fulfil their basic banking needs through these popular social media platforms, without having to login to the App.

HBL continued its market leadership in shaping the e-commerce space. HBL’s e-commerce payments solution – HBL Pay Checkout – continued to demonstrate strong growth.

The Economic Affairs: What is the role of HBL in catering to the financial needs of agriculture and SMEs to boost economic growth?

Muhammad Aurangzeb: HBL has played a leading role in developing the agriculture ecosystem, focusing on digitalization as a means to achieve farmer convenience.

HBL maintains a leadership position in Agricultural Financing and has been recognised by SBP as the “Top Ranked Agri Lending Bank” amongst large banks. The regulator has also designated HBL as the “Champion Bank for Balochistan” to lead the banking industry and enhance agricultural credit and financial inclusion in the province.

HBL’s farm-to-processor pilots successfully expanded during 2021, scaling up in-kind financing. To create a more integrated agriculture ecosystem, HBL partners with input suppliers, mechanization vendors, and bulk buyers who provide inputs at the farmers doorstep and modern farm machinery on a rental basis. This engagement serves to raise capacity, increase production efficiency and improve crop yield.

In 2021, HBL has been recognized as the “Best Bank for Small and Medium Businesses” for the 3rd consecutive year by the Pakistan Banking Awards. The Bank is an active participant in State Bank of Pakistan (SBP) led initiatives like the Kamyab Jawan Scheme.

The Economic Affairs: Please share the achievements of HBL through its overseas branches to help boost international trade and help facilitate the Pakistani diaspora abroad.

Muhammad Aurangzeb: HBL enjoys a significant international footprint and is the largest domestic multinational Bank. The Bank’s international footprint is important as it provides opportunities to effectively serve its core clients across its network.

China remains the lynchpin of HBL’s international strategy, and the Bank is the largest executor of CPEC related financing in Pakistan. In November 2019, HBL created history when the HBL Urumqi Branch formally commenced the RMB business by becoming the first and only bank from Pakistan and one of the three banks from the South Asia and MENA region to offer end-to-end RMB intermediation. HBL’s Beijing Branch commenced operations in March 2021 and serves as the main engine for origination and execution of Chinese transactions. HBL now serves some of the largest Chinese enterprises in multiple countries, furthering our objective of being a bank of relevance in the region.

The Economic Affairs: Please highlight the CSR initiatives taken by HBL and what difference was made by these steps.

Muhammad Aurangzeb: Giving back to the country and the communities that we serve is part of HBL’s strategic agenda. To promote sustained economic and social uplift of the communities it serves, HBL contributes 1% of its annual profit after tax to the HBL Foundation. The Foundation supports organizations primarily working in the fields of healthcare, education, and community development.

Art plays a critical role in the lives of people and its impact on society. As a patron of art in Pakistan, HBL is committed to celebrating the outstanding artists that the country has produced and to creating opportunities for the public to engage with art.